March 24, 2011 at 11:09 am

March 24, 2011 at 11:09 am

Hey,

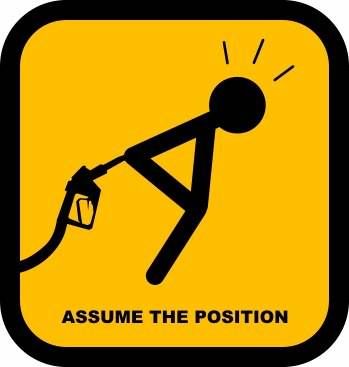

As we all know, the new 2011 budget was announced yesterday.

However, reading this on BBC News about how jobs will go after the tax hike. It really does make your bloody boil when they are making healthy profits. The increased tax is being used to generate an extra £2bn.

I fail to have even a morsel of sympathy when one oil company alone made a £3.6bn profit in the first quarter of this year.

Scary stuff!

By: Sky High - 24th March 2011 at 20:30

Spot on but credit given was also credit taken. No one forced anyone to borrow more than they could afford, so there is no one else to blame but themselves.

By: ThreeSpool - 24th March 2011 at 20:09

I think a big part of the recession was credit given to those who couldn’t afford it in the first place. Everyone else who could manage a sensible debt before, should still be able to now, even with tightened purse strings.

By: MSR777 - 24th March 2011 at 19:53

Nice one Dr.S. The car parks where I live are full to overflowing with big black cars, sorry, but most seem to be 4WDs. I don’t get this black car thing, we’re all going to end up in one soon enough. We have shops with ladies clothing items in their windows at over £500 a shot, a jewellery store with several items in its displays costing over £2000, and a watch costing much more than that, and there appeared to be no shortage of takers. Last Saturday was so busy here, other than Xmas time, I had never seen anything like it. What’s all this guff about a recession?

By: Dr Strangelove - 24th March 2011 at 16:32

Bandits the lot of ’em!

By: Sky High - 24th March 2011 at 13:54

In response to your last point, yes, of course it will. Just as any business, when saddled with extra costs over which it has no control, will eventually recoup them.

Secondly “sizable” is relative and in the context of your comment, meaningless. And be under no illusion, companies if this size will have no compunction about setting up their HQ elsewhere if there are clear benefits from so doing. The cost of doing business in the UK, as you put it, is a cost which any company is free to avoid if it chooses.

By: ThreeSpool - 24th March 2011 at 13:46

The “plucking” of a large number was no more than conveying that these companies are making really quite sizable profits in the current economy.

The UK is a sizable market for these companies, they are not going to pull out. How many of these companies are truely British? It is a cost of doing business here in the UK. It is not just one company getting saddled with the bill.

In my cynical view, it is largely pointless – it’ll get passed down to us all, eventually.

By: Sky High - 24th March 2011 at 11:21

I suppose your reation is inevitable when the very word “profit” is seen as dirty in 2011 Britain. How you imagine industry works, I do not know. Plucking a number because it is “large” is meaningless, unless you provide full details of the distribtion of the profits towards short and long term investment.

What is quite clear is that the more big business is taxed inthe UK the more likely they arev to move elsewhere, thereby cutting off the considerable tax income to the Treasury. On the figures you have quoted HMRC would receive tax income of nearly £4 billion annualised on reducing Corporation Tax levels. How would that be replaced?