No, he’s arguing with himself, in great detail and at great length using half baked but verbatim tabloid arguments, selective data, well-known logical falacies and dim assumptions. I really can’t be bothered. J8h

I have already said I think the figures in the Labour manefesto are optimistic. At least they have a manefesto and not just a lot of pictures of May looking strong and stable.

Fewer and less are used interchangeably by the under-educated who don’t know the difference.

Scarily high graduate salaries. On which planet? Or is 19-22,000 scarily high? http://www.instantoffices.com/blog/reports-and-research/average-uk-salary/

Selective data? I’ve used data from the last 37 years. Corbyn’s proposed corporation and higher rate income tax levels have already been in place at some point in the last 15 years however, and never raised anything like the amount Corbyn claims either in real terms or as a percentage of GDP. In fact, they raised less than nothing vs the current take in real terms. His manifesto is pure fiction and the evidence is right there in large graphs for anyone with an open mind to see.

They’re not optimistic, they’re just plain wrong and not wrong by a small amount, completely wrong and like I said, the evidence is there in large graphs to prove that they’re wrong.

Does that figure include graduates who haven’t found graduate jobs? Probably. What type of degree? Good one, or waste of time? The graduate starting salary at BAE SYSTEMS 16 years ago was more than £22,000.

2014

The average salary for mechanical engineering graduates with a bachelors degree was £25,000; those with an integrated masters averaged £27,000

The average salary for civil engineering graduates with a bachelors degree was £25,000; those with an integrated masters averaged £25,500

The average salary for electrical and electronic engineering graduates with a bachelors degree was £25,000; those with an integrated masters degree averaged £27,000.Starting salaries for leading engineering graduate schemes

The following figures relate to starting salaries for 2017.Associated British Foods – Grocery graduate salary: £30,500

AECOM graduate salary: £23,000–£26,000

Airbus graduate salary: £26,000+

Air Products PLC graduate salary: £30,000

Amey graduate salary: £24,500–£26,500

AWE graduate salary: £23,220–£23,720 depending on experience

Babcock International Group graduate salary: a minimum of £25,000, although many schemes offer £27,000-£30,000

BAE Systems graduate salary: a minimum of £28,000 (graduate development framework); £30,000 (finance leader development programme and sigma leadership programme)

BP graduate salary: £33,000–£40,000

British Sugar graduate salary: £30,000 (engineering and electrical engineering programmes only)

Caterpillar graduate salary: £27,500–£28,000 for the engineering programme and £26,500–£27,000 for non-engineering programmes depending on experience

DSTL graduate salary: circa £23,000

EDF Energy graduate salary: £27,500

E.ON graduate salary: £29,000 starting salary

ExxonMobil graduate salary: £37,500–£42,000 depending on qualifications

FirstGroup graduate salary: £26,000

Imagination Technologies graduate salary: £25,000–£30,000

Jaguar Land Rover graduate salary: £29,000

Johnson Matthey Plc graduate salary: £28,000+

Laing O’Rourke graduate salary: £27,000

Leonardo graduate salary: £26,000

Lloyd’s Register graduate salary: £25,500–£27,500

Mars graduate salary: £28,420 (engineering and R&D programmes)

MOD/DESG graduate salary: £25,077

Mott MacDonald graduate salary: £25,000–£28,000 depending on location and qualifications

National Grid graduate salary: £27,500–£28,500 depending on qualifications

National Instruments graduate salary: £27,500

Network Rail graduate salary: £26,500

Nestlé graduate salary: £27,000

Nissan Motor Manufacturing UK graduate salary: £29,660

nucleargraduates graduate salary: £25,000

Rolls-Royce graduate salary: £28,000

RWE npower graduate salary: £30,000–£35,000 (quantitative risk scheme); £26,000 (other schemes)

RWE Generation UK graduate salary: £29,000

Shell graduate salary: £30,000–£35,000

Thames Water graduate salary: £28,000

Transport for London graduate salary: £26,000

UK Power Networks graduate salary: £31,000

Unilever graduate salary: £30,000 (Unilever Future Leaders Programme, which includes R&D roles)

Unipart Group graduate salary: £26,500

Wates graduate salary: £20,500–£27,500

All the ones in bold are realistic for those with a 2:1 or 1st in engineering, although the oil companies are very difficult to get into but high 20s is definitely doable. The problem is that your figures for the overall average are distorted by people with:

a) Degrees in ****ty subjects;

b) ****ty grades.

2017

http://www.savethestudent.org/student-jobs/whats-the-expected-salary-for-your-degree.html

The current average graduate salary in the UK is just shy of £23,000, but we’ve also heard folk reporting everything between £16,000 and £70,000!

http://www.savethestudent.org/student-jobs/whats-the-expected-salary-for-your-degree.html#table

Degree Subject Average Graduate Salary

Accounting & Finance £23,180

Aeronautical & Manufacturing Engineering £25,588

Agriculture & Forestry £20,696

American Studies £20,618

Anatomy & Physiology £21,988

Anthropology £20,395

Archaeology £20,000

Architecture £19,864

Art & Design £19,669

Aural & Oral Sciences £23,658

Biological Sciences £20,624

Building £26,286

Business & Management Studies £23,952

Celtic Studies £19,793

Chemical Engineering £28,603

Chemistry £22,817

Civil Engineering £25,550

Classics & Ancient History £22,460

Communication & Media Studies £19,258

Complementary Medicine £28,259

Computer Science £25,203

Creative Writing £18,133

Dentistry £30,432

Drama, Dance & Cinematics £19,659

East & South Asian Studies £23,723

Economics £28,157

Education £21,896

Electrical & Electronic Engineering £26,146

English £20,065

Food Science £22,249

Forensic Science £18,825

French £22,171

General Engineering £27,157

Geography & Environmental Science £22,001

Geology £24,818

German £22,416

History £21,621

History of Art, Architecture & Design £20,349

Hospitality, Leisure, Recreation & Tourism £20,130

Iberian Languages £22,161

Italian £21,731

Land & Property Management £24,505

Law £20,421

Librarianship & Information Management £24,576

Linguistics £20,261

Marketing £21,565

Materials Technology £22,468

Mathematics £25,840

Mechanical Engineering £26,361

Medical Technology £22,652

Medicine £28,191

Middle Eastern & African Studies £22,412

Music £19,956

Nursing £22,840

Occupational Therapy £22,407

Ophthalmics £16,286

Pharmacology & Pharmacy £19,746

Philosophy £24,377

Physics & Astronomy £25,047

Physiotherapy £22,331

Politics £23,603

Psychology £19,927

Russian & East European Languages £23,973

Social Policy £20,555

Social Work £24,761

Sociology £20,518

Sports Science £19,888

Theology & Religious Studies £21,824

Town & Country Planning and Landscape Design £22,775

Veterinary Medicine £26,872

Software

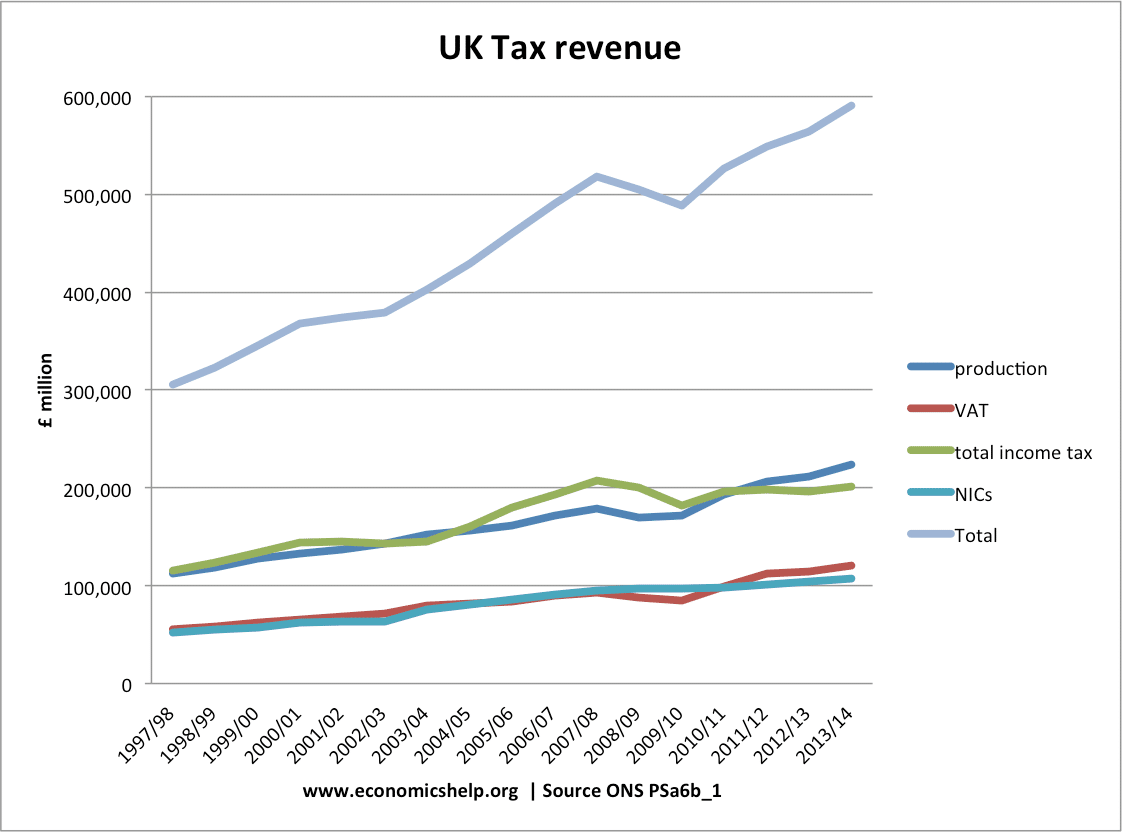

Corbyn’s assumptions on income tax, which are presumably to raise the bulk of the remaining $29bn for $49bn total.

The higher rate of income tax was 50% from 2010-2012 for a much wider income band.

How much extra did it raise? Nada. It actually started falling in terms of receipts until the government put it back down to 45%, page 12. This is what happens when a tic-tac-toe player comes to a chess table.

So $49bn of pure BS, that will be added to the debt of the next generation every single year, with interest, interest that will also likely increase. Don’t do it.

http://www.itv.com/news/2017-05-16/general-election-2017-labour-launch-party-manifesto/

This will include £19.4 billion through corporation tax which would increase to 26% by 2022, bringing in an extra £20 billion.

I just proven that historically there’s no evidence of anything like this ever having even nearly happened post WTO. Take it or leave it.

‘None of my friends’. What do you guys do, payday loans? Ok, I’ll turn that one around.. who did you know that killed themselves because of a Labour government? Seriously.

“All I know is…” – a very telling phrase.

People usually get better off. Demographics don’t always, and are not now. Compare today’s twenty-five year olds with how today’s forty year olds were when they were twenty-five. That is the difference between the individual aspiration model and the long-term societal. Not that I expect you to have got past the first long word.

Seriously, **** you and your assumptions. My mum worked as a call-handler at a call-centre and my dad was a scaffolder. (Is that enough working class for you?) I worked hard at school, got a first in engineering and now work as an engineering contractor. I have friends who didn’t go to university and some who did. They are all working and none will be worse off under May. Both my parents and myself, and my brother and my sister will vote conservative. Why? Because we’re smart enough to recognise complete and utter bull**** when we see it.

Suicides as a result of last Labour government:

http://www.bmj.com/content/345/bmj.e5142

When presented with all the historical evidence on corporation tax, all you knew was how to be pedantic about grammar. I’ve got news for you, grammar and even spellings change with time. 200 years ago ‘pigeon’ was spelt with a ‘d’. Sometimes people just decide that existing rules are bad and ignore them en masse, like they do with ‘less’ and ‘fewer’ and eventually the rule gets changed.

I can tell you that graduate salaries for those in their early 20s are scarily high. If you’re talking about less educated 25 year-olds, then what do you expect? The last Labour government signed up to a treaty that flooded the country with low income migrants that were aged below the threshold for the £7.20/hour minimum. And wage levels dropped? Shock horror. They also introduced and increased tuition fees so that banks could profit, instead of keeping the number of student places at a sustainable level, one where all graduates might actually have a chance of getting a graduate job. Personally, I would reduce student places by 33% and bring back free higher education. That way the right people get to go to university for free, purely based on academic excellence, regardless of family wealth and it won’t cost the taxpayer any more either. The reduction in supply in the graduate job market might also marginally increase salaries.

Corbyn’s maths? Do you really think he or the Prime Hypocrite sit down with a calculator?

Corbyn no, current chancellor, yes.

None of that waffle has any bearing as we are looking at claims regarding a future scenario, not adding up anything that happened in the past. Not that you have shown anything about that either.

The past is our usually our best indication of the future, only in this case the future effects of large corporation tax rises are even less likely to yield large returns due to exit from the EU.

And by the way it’s ‘fewer’ companies, not ‘less’. I will not take ill-thought-through lectures on economics from a tory with no grasp of basic grammar.

These days they’re used interchangeably. If words like ‘gadar’ have made it into the oxford dictionary, I hardly think its opinion counts anymore. And I will not take pedantic grammar pointers from someone who can’t count. And you will not be able to count the number of companies leaving under Corbyn, so I retain the right to use ‘less’.

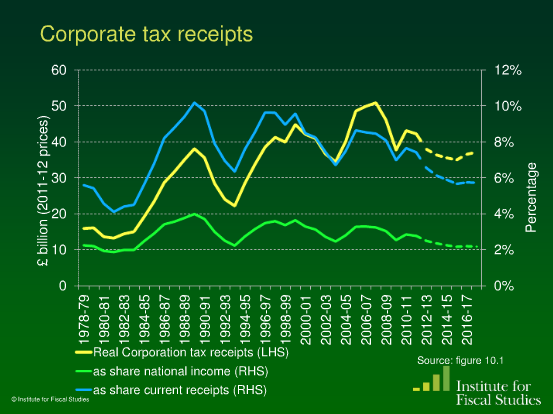

The world was not globalised? Do you have the foggiest idea of what you mean by that?

Yes, the WTO in 1995 put limitations on tariffs, in the early ’80s there were no such restrictions, so companies couldn’t simply up and leave as easily. And even then a 48% corporation tax only raised £22bn adjusted for inflation, which was 4.0% of GDP vs 3.0% now (33% rise). So we didn’t even get the 50% rise in receipts Corbyn thinks he’ll get, under a 48% corporation tax, pre-WTO, whilst in the EEC. And that’s all measured against GDP, which itself was lower back then (in real terms) and will fall under high corporation taxes. In real terms we have never collected more than the current £56bn in one year, ever, not at 28%, 30% or 52%, not even at the peak of the housing boom at 30%. I have presented irrefutable evidence that Corbyn’s strategy will not work, so if you want to land the next generation in debt go right ahead, but I’ll make note of this conversation and bring it back to haunt you and others in the future!

And have you seen the land tax Corbyn intends to institute. £5000 extra to the average family. £11,000 if you live in London.

http://www.telegraph.co.uk/news/2017/05/29/tax-homes-treble-labour-plans-land-value-tax/

The IPPR also warned that the tax “might push some heavily mortgaged homeowners over the edge” and lead to repossessions.

The National Farmers’ Union has warned that by imposing land tax on agricultural land “it would simply increase the cost of UK food production with no benefit for shoppers”.

And the inheritance tax threshold will be £425,000 instead of £850,000. So instead of some people paying for social care, everyone over an asset value of £425,000 will pay. Too bad for anyone who lives in London.

I would also add to the above, if you take the period of 30% corporation tax, 3.5% vs 3% was raised, 17% more with 60% higher rate (30% vs 19%). That implies less companies paying it, which implies less jobs, less income tax and more welfare expenditure. And that’s in a pre-Brexit environment. And is the GDP that it’s a % of even as higher when the corporation taxes are higher? Well no, that’s why 60% higher tax doesn’t raise 60% more. So it’s 17% more only as a % of a lower GDP figure when tax is at Corbyn levels. So Corbyn’s maths is a crock of crap.

In fact, as econd look at the graph and I think the rate was 33% when 3.5% of GDP was raised, at 30% at the peak of the housing boom, it was only 3.2%!

As you wished, the yellow line is Real (adjusted for inflated) Corporation Tax Receipts. The actual date stops at 2012, but we are now at £56bn, which is a record amount.

Historical Corporate Tax Rate.

Here’s one up to 2015, as a % of national income (GDP). We are now at £56bn, which ~3% of GDP. So to gain an extra £18.67bn, up to 4.0% of GDP, requires a corporation tax rate of about 48% (1984-85), which actually brought in a lot more than 1981, when it was 52%. But bear in mind, the world was not globalised back then and the WTO didn’t exist. The most a 30% rate ever brought in was 3.5% GDP, which is about another £9-10bn, not a large percentage of £48bn and whether it would even raise £10bn now and after Brexit is hugely debatable, or it might be 3.5% of a smaller GDP. Tax rates are chess not draughts. E.g. tax rates in Germany and France are 30% in total, so would a company want to pay 30% in Germany and have access to the single market, or 30% in UK, with tariffs. Equally, Ireland is at 12.5-25% depending on business type. That is the problem with Corbyn’s policies, they do not present the ability to walk away from a bad deal with the EU, so they are a bad negotiating position. Whereas we are now at 19% for all businesses, and a May government would retain the ability the drop it to 9-10% to offset tariffs and more if the EU tries sell a bad deal by using tariffs on EU imports and other saving of not being in the EU. But you get the picture, a 60% rise in corporation tax only gives you a 16.7% rise in receipts as a % of GDP, even when we’re in the EU and increasing it by 150% (1984-85) only gave an extra 33% as a % of GDP whilst in the EEC and pre-globalisation/WTO when tax avoidance was a hell of a lot more difficult.

For who? Mine hasn’t, my brother’s hasn’t, my sister’s hasn’t and none of my friends’ has. All I know is that after the last labour government, people were losing their homes completely and killing themselves.

Which income tax bands have the conservatives increased?

And on Corbyn’s plans to raise corporation tax to 28%. It was at 30% in 2009. The result is you take £20bn less. So that’s £20bn extra he now has to make up, which actually puts his figures nearly £30bn short. The were £9bn short even if all the companies paid, plus £20bn indicated by graph. So so far he’s added £30bn (1.5%) to the deficit. Now you have even less to spend the following year unless you borrow even more still. His policies are based on ‘sound good’ bull**** for the young and the dumb, which have been historically shown to fail to do what he says they do.

https://www.ft.com/content/ca3e5bd2-2a7e-11e7-9ec8-168383da43b7

Look at it this way Beermat. In order to get a good deal from the EU, we have to be prepared to walk away. If you intend increasing corporation tax by 50% and instituting a £10/hour minimum wage, you can’t do that. Those things on their own will drive away businesses, add tariffs on top and its a dead economy.

Even the £10 minimum wage on its own is problematic. 60,000 people are likely to lose their job as a result, even ignoring higher corporation tax and potential Brexit effects.

After Corbyn, your children will grow up in a world where an even higher % of revenue is taken up by servicing the national debt. There’ll be even less money left for education and the NHS, and less jobs. Corbyn is offering a pay-day loan solution to public sector spending.

And don’t twist words, I didn’t say those who are not wealthy are stupid, I said those who are poor are usually stupid. The Conservative’s income tax regime benefits pretty much every working person. They have never taken away from people who are working.

Putting it bluntly, yes, they probably are.

Well technically everyone can get a loan to go to university. However, I am in favour of free higher education but I would pay for it by reducing student numbers by 33%, since we currently subsidise 2/3 to 3/4 of the cost anyway. Higher education stopped being free because they started sending stupid people to university.

Research hasn’t been cut.

Corbyn will put the country into further debt, then more money will be taken servicing that debt, leaving even less to spend when austerity 2.0 finally comes around, and then idiots will blame the Conservatives again.

I think I’ve presented sourced figures in my pro-Brexit arguments and ways tariffs can be overcome. And my figures actually balance, unlike Corbyn’s

Out of the 3 main EU net contributors, UK GDP has grown fastest over the last 3 years, yet it grows slower than the Eurozone as a whole. So what we see is that the subsidies provided by the UK, France and Germany are stunting their own economic growth for the sake of others.

There is nothing stupid about Brexit, but any plan where your revenue does not match your expenditure is very stupid. However, by promising that expenditure goes to stupid people, stupid people will vote for you, regardless of the long-term impact on the country and future generations.

ROTFL.. From an F-35 fanboy that’s almost insulting

He’s right though. Pilot’s stories depend on which pilots you ask. Between that and unofficial blogs, you can build up a truly exceptional image of an otherwise ordinary aircraft.

i just said that F-35 wand not the most persistent plane, particularly during high speed combats over the sea. Like it or not, pilot testimony, not nyour fanboyism. Source is in latest raids aviation. 3pancho” testimony. Very funny how you get touchy. Btw, mrmalaya, at least nthe french build ,a,plane. They are not just subcontractors as uk.

Did anyone notice there were positive feedback on F-35 and i nsaid it?In the meanwhile, real cost of LRIP9 is skyrocketing… https://www.fpds.gov/common/jsp/easySearchView.jsp

The UK also have a plane and are Tier 1 partners on another and it’s a tactic that will effectively result in far more exports. And I don’t think your link works. And can persistence with 3 2000L tanks really be compared to that clean?