Ryan, the ‘current’ Conservative party came into being with the drafting of the Tamworth Manifesto in 1834, so I doubt it.

You know well what I meant. Before 2010.

What is slightly awkward for your line of reasoning regarding pensioners, it appears they were the only section of the population who voted in greater numbers for the Tories than Labour. in the ratio of approx 5/2

Every other segment voted more for labour according to a new survey

True but then how many retirees would have voted Tory if it wasn’t for the anti-OAP policies and perhaps younger people don’t like losing their inheritance but do like debts being written off? If I thought he could actually do what he promised I might even vote for him, but every bone in my body along with every shred of data available says he can’t.

That block of flats has been there a lot longer than the current Conservative party.

I doubt that will happen but the EU has definitely underestimated how strongly they feel about this.

The shift in graduates to Labour is, I think, easier to explain. For starters Labour promised to abolish and pay-off all student loans; that alone has got to account for much of the swing, even if students weren’t typically ‘anti-government’, which they always are.

So the Tories promised to take away people’s houses and Labour promised to take away tuition fees and student debt? I wonder why the Tories did so badly.:rolleyes: Sadly though, despite the beard, Corbyn is not Jesus and cannot simply remove the cost of everything.

BM, in the short to medium term you can get a fall, because it takes companies time to move. And I also think emphasis needs to be placed on the term ‘estimated’.

And if the national income goes up as a result and the share stays the same, then that sounds pretty good to me. More companies, more employment, corporation and income tax receipts go up but stay the same as a % of national income.

Come on, hit me with another graph.

You asked for it…:eagerness:

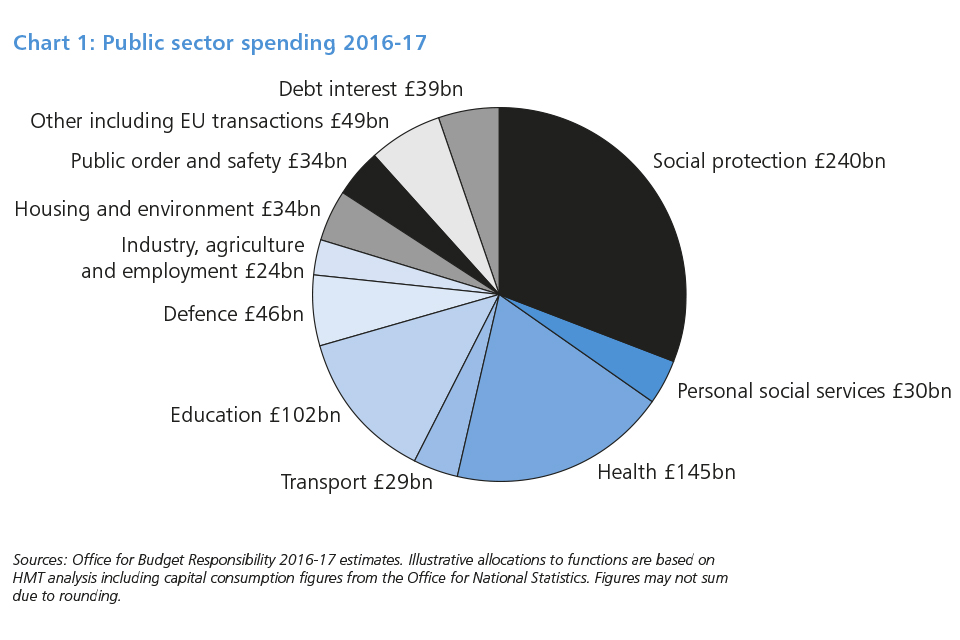

..and where do you think the money spent on the NHS actually goes? It’s a profit for someone, Ryan. Healthcare is big business, and it has been for a long time.

And yes, we should look at UK tech companies, financial services etc. I don’t understand how that counters my point.

Once again, it would be interesting to see the make-up of the corporation tax take.

If you look at the first link, chart 1, you’ll see corporation tax receipts from the banking sector have seen a small rise, with a larger rise in bank payroll taxes and levy, despite reducing corporation tax rate. Meanwhile figure 8 in the second link, shows that the amount has gone down as a percentage of national income. All the corporation tax receipts post 2010, are higher than those before, even though the corporation tax rate was 30% back then. I would say this implies more banks paying less tax, making a higher total receipt of corporation tax.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/548384/PAYE__Corporate_Tax_Receipts_from_the_Banking_Sector_2016_FINAL.pdf

https://www.ifs.org.uk/uploads/publications/bns/BN_182.pdf

Now I have a breakdown, but it does not go as far as the FT graph, stops in 2015-2016 not 2016-2017. Figure 1 in link. I&C receipts have risen. Financial sector receipts slumped after 2008 but are now rising, as are life assurance receipts. North sea oil company receipts are down for obvious reasons. Also see table 11.1B.

Get your popcorn and cola out.:eagerness:

http://www.news24.com/World/News/eu-sanctions-3-countries-over-refugees-20170613

EU sanctions 3 countries over refugees

A migrant from Morocco walks among tents at a beach outside the Souda refugee camp in Greece. (Petros Giannakouris, AP)Strasbourg – The EU on Tuesday launched legal action against Hungary, Poland and the Czech Republic for refusing to take in their share of refugees under a controversial solidarity plan.

The move shows the frustration in Brussels over the scheme, which aimed to relocate 160 000 migrants from frontline migrant crisis states Italy and Greece but which has so far seen only 20 000 moved.

EU Migration Commissioner Dimitris Avramopoulos told a news conference: “I regret to say that despite our repeated calls, the Czech Republic, Hungary and Poland have not yet taken the necessary action.

Ensuring security

“For this reason the (European) Commission has decided to launch infringement procedures against these three member states,” he said at the European Parliament.

The three eastern European states have led resistance to the plan since its outset in 2015 at the height of the migration crisis, when more than one million refugees landed on Europe’s shores.

But Avramopoulos, who is Greece’s European commissioner, criticised the countries for expecting the benefits of EU membership while not taking on responsibilities.

“Europe is not only about requesting funds or ensuring security,” Avramopoulos said. “Europe is also about sharing difficult moments and challenges and common dramas”.

Brussels last month set a June deadline for Warsaw and Budapest to start accepting migrants under the plan to ease the burden on Italy and Greece, or risk sanctions.

Prague also came under pressure after effectively dropping out.

Under “infringement” proceedings the European Commission, the 28-nation EU’s executive arm, sends a letter to national governments demanding legal explanations over certain issues, before possibly referring them to the European Court of Justice.

EU states can eventually face stiff financial penalties if they fail to comply.

Screen jihadists

Avramopoulos said Hungary and Poland were targeted because they had failed to admit one single person under the “relocation plan” adopted in 2015 to redistribute among other member states 160 000 mainly Syrian, Eritrean and Iraq asylum seekers from Greece and Italy by September.

He said the Czech Republic was targeted for having relocated nobody in the past year and failed to issue any new pledges to admit asylum seekers.

In the latest EU figures, just over 20 000 people have been relocated under the plan, which was in response to Europe’s biggest ever migration crisis.

European sources have blamed the delays on a series of factors: governments trying to screen jihadists in the wake of terror attacks; a lack of housing and education for asylum seekers as well as logistical problems.

They said some countries were setting unacceptable conditions by refusing Muslims, black people or large families, with Eastern European states the worst for discriminating on religious or racial grounds.

What is more, has no-one considered that the ‘Everyone who votes Labour is stupid’ interpretation of the graphs completely overlooks the possibility of inverse causality.

What if a Government (or rather their civil service advisors and the CBI, let’s not give them too much credit) sees increased profitability of private uk business (think privatisation and the farming out of cash-cows to the likes of Capita, plus the city) and is thus given a free hand to reduce rates for ideological reasons, and yet maintain the take?

Not desperately trying to prove this is in fact the case, just giving one example in an attempt to illustrate the pointlessness of an ill-thought through graph.

What might help settle this would be a breakdown of where the receipts come from and how that has changed – or not – over time. If it shows an increase made up foreign companies chosing to declare their profits in the UK then I will concede the point. I doubt it will.

One should look at the number of automotive, tech and financial services companies based here.

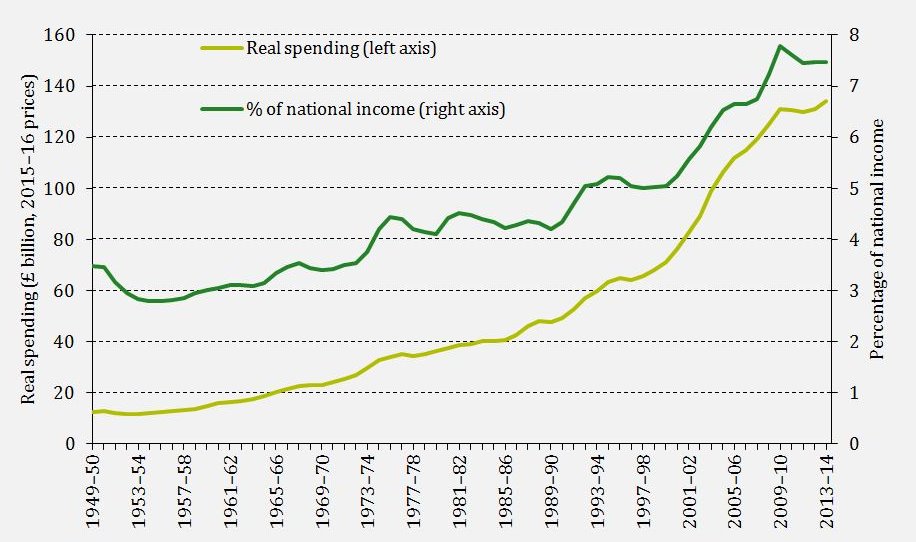

This phenomenon isn’t something that started in 2010, so your cash cows theory doesn’t hold. Government spending has increased but it has provably been on the NHS.

Education spending now as high as it ever was under Labour.

Another interesting graph on NHS spending.

TonyT – Labour would need to form a coalition with every other party to hit 326 seats, including Sinn Fein who never sit in Westminster. You’re talking about a 7 party coalition.

Yes, whoever asked this morning. I can see graphs showing increased coroporation tax takes and reduced rates in very recent years. Could hardly miss them, so often has that data been refered to and repeated as ‘proof’ of everyone else but Ryan’s stupidity.

Talking of which, higher education is ‘buy now, pay later’ now.

Overly tax a company and they might consider moving, maybe, but where? The ones that can operate from tax havens do so already. There are, as the FT have explained, a plethora of reasons for the location of a company – or they would ALL officially be in Ireland, Jersey or the Bahamas. There are also a plehora of reasons for recent raises in tax take – including banks paying more twice as much tax against reported profits and shifts in the recording month.

What the figures DO NOT demostrate are any companies moving to the UK for tax reasons.

The Euro clearing bank is moving to France. For tax reasons? Nope.

It costs a given amount to set up a wing in a tax haven, but if corporation tax rates are high enough, it’s still frugal. There is also home market size and cost of exporting to be considered in some cases, as well as other costs (minimum wage, employer NI contributions……. Marxist land taxes etc.)

If the GDP is rising faster than that of France and Germany who have higher tax rates (30-33%) total, surely that is an indication of companies choosing to locate here rather than elsewhere.

https://tradingeconomics.com/united-kingdom/gdp-growth

https://tradingeconomics.com/france/gdp-growth

https://tradingeconomics.com/germany/gdp-growth

Well the Euro clearing is a political football, so lets not get into that but it could end up costing businesses on both sides money.

Forced relocation “would also likely increase capital requirements for EU firms,” ISDA chief executive Scott O’Malia said. “These costs will undoubtedly feed through to clients in both the UK and EU, making it more expensive for them to hedge their risk.”

The Washington-based Futures Industry Association, a trade organisation for the futures, options and centrally cleared derivatives markets, has said forced relocation “could nearly double margin requirements from $83bn to $160bn.”

And lots of working forests there too, growing twice as much wood as harvested for construction/furniture and compressed wood pellets in some cases.

I’m more worried about this Brexit bill right now.

https://www.cer.org.uk/sites/default/files/pb_barker_brexit_bill_3feb17.pdf

There is some horrible maths even in the 60bn figure.

1) They have undervalued EU assets 7-fold.

http://bruegel.org/2017/02/the-uks-brexit-bill-could-eu-assets-partially-offset-liabilities/

2) They have assumed the UK owes full pensions for every current EC retiree or worker. Surely if you are only employed for part of a full working life by someone, you don’t get a full pension. And only 8% of retirees and 3.8% of current employees are British, yet they want 15% to be paid by the UK. Surely they should have to make some people redundant and downsize now that the EU has left.

3) No acknowledgement of UK rebate in calculating our share, although I assumed they’d include 2019 and 2020.

4) Sure our liabilities should also be considered. E.g.:

a) Unpaid student loans outstanding with missing debtors, that were lent to comply with the Lisbon Treaty. Student course fee liabilities for those EU citizens part way through a course.

b) State pension, healthcare, social care, JSA and welfare liabilities.

5) Money for unrealised contingencies? Coverage of EU loan liabilities not made to the UK?

All seems very inaccurate, can only imagine what the £100bn breakdown looks like.

6) EFSI seems to be about mobilising private investment, so how is that a UK taxpayer liability?

Well let’s not be hasty about this analysis. At the end of 2015 the NHS said they needed 15,000 more nurses but that appears to be roughly what they got. This all has to be seen in the light of balancing budgets and even with increased NHS funding maybe this is just what we can afford right now. And it’s likely the foreign nurses were also coming because of the bursary, so maybe it’s more about that than Brexit.