Totally agree, you do not borrow your way out of trouble, that is just the policy of an imbecile, debt is debt and increasing the debt will not cure the countries woes any time soon, simply push the problem a few years into the future when it will take even more drastic measures to rectify.

Corbyn and his manifesto bought his votes on the tax burden of the future generations.. it’s all right having free university education, but its a buy now pay later policy. Nothing in this world is free and the sooner people wake up to the fact the better. Overly tax Corporations and they will up sticks and move.. why do you think Companies have bases in Ireland, Luxembourg, Jersey… its for one reason and one reason alone…. lower tax burden.

I should also point out that for the remainder of our time under the Lisbon Treaty, free higher education would also mean free higher education for EU students, which is a potential money black hole.

My goodness Ryan, something we can agree on is buried in the last post (although are you sure you are feeling OK as there wasn’t a graph contained within it?)

Equalised NI for the self-employed and employed.

However, it got shouted down after the last budget. Dare they try it again?

I only ever paid standard rate tax and NI through PAYE for the first 34 years of my working life, even as a senior teacher and Head of Department I never quite reached the Higher rate tax threshold. When I became self-employed I was surprised how much less NI I was expected to pay on an annual basis compared to my previous monthly payments

I think the main argument against was that it flew contrary to manifesto promises, or at least appeared to.

And self-employed benefit form flat-VAT rates as well, if they agree not to claim VAT back. It keeps things simpler and results in a little more cash for them.

Quite idly, I wonder what was the cost of manufacture, installation and maintenance of the ‘renewables’.

http://fr.zone-secure.net/5521/295661/#page=11

fair proportion of the ‘renewables’ is going to be wood-chip burnt in modified ‘coal-fired’ power-stations.

Yes, there’s one power station that provides 16% of it this way on its own.

Bruce, I think they need more funding for health and social care and perhaps if they made a small increase on the cap on social care costs from £76,500 to £86,500 and raised NI payments by 0.5p but also raised lower threshold to offset the affect on the very poor and equalised self-employed NI contributions with those of the employed since they now enjoy the same benefits…. that could work. And at least it follows the mantra of “we’re all in this together”, rather than, “OAPs, you’re on your own.”

The manifesto doesn’t quote a figure but I’ve seen a figure of 26% quoted for corporation-tax; that’s not a ‘little more’, that’s nearly a 37% rise in corporation-tax!

Plus that’s only on the large corporations, corporation-tax on the small and medium-sized enterprises would actually go down under Labour’s plans (so raise less tax?); I’ve not seen any politician or political commentator comment on this vital fact…

And yet he’s still assumed 37% extra corporation tax receipts. +£20bn on current £56bn. So by raising corporation tax on the largest companies (i.e. large multi-national who can base their tax HQ anywhere and only make up 40%) by 37% and lowering taxes on smaller companies less able to move, he proposes to raise corporation tax receipts by 37%.:stupid:

http://www.itv.com/news/2017-05-16/general-election-2017-labour-launch-party-manifesto/

CD, Ryan’s premise was increasing rate of corppration tax decreases take, not that reducing it increases take.

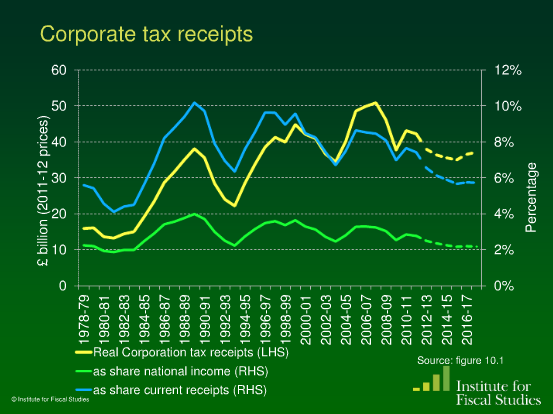

Sure enough a selective sample shows decreasing rates and increasing take (but only that, not a causal link). A larger time-frame doesn’t even show that. Taking tax as a proportion of GDP weakens the negative correlation still further.

I have not produced a graph showing increasing corporation tax against tax take since the current system was introduced in 1972 because there hasn’t been a rise, not because of ‘intellectual dishonesty”.

I’ve shown you data back to the early 1980s and even that shows increasing corporation tax receipts for lower rates.

http://themess.net/forum/political-discussion/251790-uk-may-to-seek-snap-election-for-8-june/page27

A larger time frame does show that, see above. As a % of GDP means nothing. If the receipts go up 5% as a percentage of GDP but GDP goes down 10% because companies have moved away, you still end up with less, and the above link also demonstrates this.

Why do you suppose there hasn’t been a rise? Perhaps, just maybe, it might be because reductions in rate have led to increased receipts and economic growth. And you are wrong. Look closely at the graph in the period 1981 to 1989. There are two rises here and even in a period pre-WTO, the first rise led to a fall in real receipts up until 1982 when they started reducing it and the second rise in 1986 reduced the rate at which the increase was climbing, then the recession hit in 1991. This is also pre-WTO, meaning it was far more difficult for companies to up and leave during this period. You also have the affect of leaving the EU to consider in setting corporation tax rates.

Interesting stats:

March 2017

0.78GW Coal

4.4GW Gas

7GW Nuclear

12GW Renewables

50:50 even in a dark wintry month.

Coal now makes up only 9% vs 42% in 2012.

In the 3rd quarter of 2016, more than 50% was renewable.

They claimed £20bn extra from their corporation tax changes.

Brexit does not stop needed personnel being brought in AND we haven’t even left yet.

Trekbuster – Maybe if you present any data showing I might be wrong then I could consider it. But so far all I’ve got is some philosophy. The data shows only one thing, to claim otherwise without rationalising it is intellectual dishonesty.

Perhaps, just maybe perhaps, given the debt ****-hole left in 2008, this is really the best we can do right now.

Sorry Ryan, you can throw all the charts and statistics you want but they can be read both ways

EG A third of all deaths on the roads are due to drink driving……………………………….. shock horror………………………. but look at it again, two thirds killed were sober, so it is safer to drive drunk. see what I mean.

These are the most illogical arguments I’ve ever heard. I mean seriously, Charles Manson has a beard, Corbyn has a beard but then so did Jesus. Is Corbyn a serial killer, the Messiah, or just a ******* Marxist imbecile? I don’t know, but maybe philosophy can refute hard data huh?

There’s a million reason why your above example holds no weight. E.g. how many of those sober drivers were using mobile phones and therefore not even looking at the road. What about the accident rate as a percentage, but then how do we know the total number of drunk drivers who were never caught and those caught may likely have been caught due to accidents leading to unrepresentative statistics….

But no, this is simply the affect of taxation on tax revenue this century! Like it or not, those graphs are hard facts, and your words are just poor substitutes for supporting data because you haven’t got any.

I now understand why 40% of the turnout voted labour. They’re completely irrational and can’t be reasoned with. There’s no evidence of higher taxes ever bringing in more post WTO. So where does the money come from? Borrowing? What like Greece?

And I think we’re about done with ‘former advisers’ if we’ve learnt anything.

My graphs show Tory policies working and Labour policies not working, can you at least come up with the converse of that, or some kind of data, rather than simply saying, “damn right, he hasn’t proven anything,” as if that has any meaning. I mean, you’re literally Monty Python’s Black Knight here right now.

I can’t speak for Beermat, however his rebuttal in #742 cuts it for me. You have a perspective, not a proven point.

So tire away, you haven’t proven anything. The statistics might lead people to a similar conclusion, and you might be able to explain your point using those figures, but that in istelf is not an absolute proofEdit: a more accurate phrase for you to use would be:” i have shown you my data and they firmly support my view that….’

Sorry but that’s bull**** and you’re an intellectually dishonest for even writing that after my above post. If higher corporation and upper band tax rates led to lower tax revenues, that means less companies here and less jobs here, which means there is less cash flowing about not more. That is the only conclusion that can be drawn from the figures, otherwise higher tax would lead to higher revenue. So what you’re doing with this policy would be replacing genuine employment income from private companies with borrowing-derived income from the taxpayer and somehow hoping that it leads to more tax being collected than you’ve paid out in the first place.

This isn’t even Keynesian economics being presented here, it’s ******* alchemy. Keynesian economics recommends lower taxes during a period of recession or struggling growth to stimulate the economy. It also recommends more spend but only in cases where you’ve ran a surplus during the proceeding boom. What’s being proposed here is increased taxes and increased spend, during a debt crisis, where the proposed tax rates have been shown to lower revenue not increase it. This does not follow any known economic model and no economist was impressed with Corbyn’s manifesto.

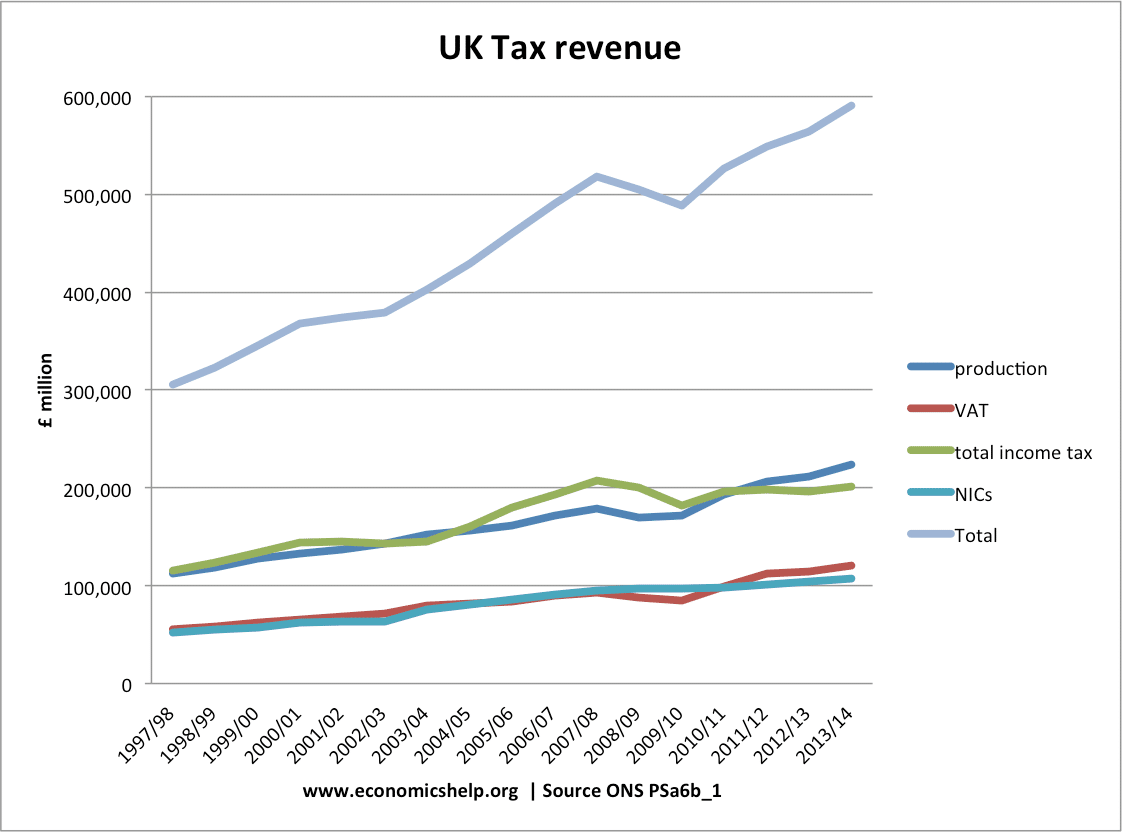

Furthermore it’s being proposed as an alternative to a currently growing economy, reducing deficit, rising tax revenue and increased government spending! Yep, you heard right, despite all the bull****, spending has increased! Seriously, you want to risk this for Corbyn and Abbot?

https://d3fy651gv2fhd3.cloudfront.net/charts/united-kingdom-government-spending@2x.png?s=unitedkingovspe&v=201706021735v&d1=20070101&d2=20171231

Thought you two would be fans of Pob. However, someone with less tact or negotiating ability would be hard to find short of a concussed cow. Ask any teacher.

Talking of which, increased spend does not ‘mean’ an equal amount of cuts in the future.

Austerity is not inevitable, and is at least as much ideological as logical.

If you really did have an historical perspective you would understand this, not as an argument of the ‘absolute truth’ of a position (there is no such thing in economics) but more as an alternative concept and one that is grasped by many.

Tax take depends upon economic performance. If there’s no money sloshing around, the argument goes, no-one buys stuff and there is no economic performance. It is an argument – I am not saying it is 100% right and excludes the necessity to keep an eye on spend – but it is not an argument to be ignored while dismissing anyone opposing savage cuts as ‘stupid’.

And as I keep saying, you cannot PowerPoint your way out of that – especially with irrelevant data.

I really tire of you Beermat. I’ve shown you the graphs proving that higher corporation tax and 50% upper band income tax doesn’t bring in more revenue but less.

This means that the £40+bn extra Corbyn says it will bring in is actually minus £Xbn, which means you are adding debt that our children will have to pay and they’ll have to pay for it with even worse austerity.

What you are talking about is Keynesian economics, which only works if you actually ran a surplus during the boom, which Labour didn’t. It works then, because you are at a debt level low enough to allow deficit spending and running up of the debt, and the extra spending kick-starts the economy. However, when the debt is at 90% you can’t run up the debt to increase spending because:

a) The IMF is watching you and will reduce your credit rating, which then means you will be paying higher interest on borrowing, which now means even faster racking up of debt to meet your spending plans and then the IMF downgrades you again.

b) If another crash happens you are truly ******.

Ask yourself this. Is the EU, who is controlling most Greek spending right now, advising them to spend away, or imposing austerity? Debt Crisis != Recession.

Is our GDP growing slower or faster than Germany’s or France’s based on last 3 years?

https://tradingeconomics.com/germany/gdp-growth

https://tradingeconomics.com/france/gdp-growth

https://tradingeconomics.com/united-kingdom/gdp-growth

Has corporation tax revenue increased, as a result of Tory changes?

http://www.ukpublicrevenue.co.uk/current_revenue (Current income tax receipts £237bn, historical figures below)

Has the deficit reduced?

https://tradingeconomics.com/united-kingdom/government-budget

To me it looks like the Conservatives have done a really good job of growing the economy, increasing tax revenue and reducing the deficit. And you want to change all that based on some old guy with a beard talking because he sounds calm and collected?

Gove might not be bad as a negotiator, or at least as a tactician in said negotiations.